Traveling to another country? Watch out for additional credit card fees!

Submitted by Wanderlust Andi

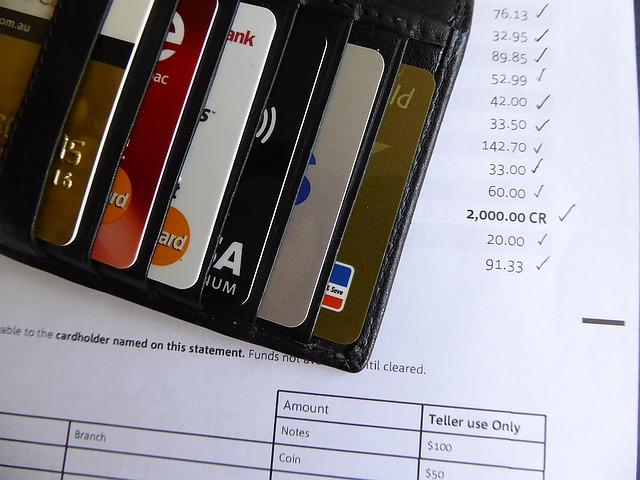

U.S. citizens should be aware of the additional fees their credit cards may rack up when used in another country (including Canada and Mexico). The two major types of fees are foreign transaction fees and currency conversion fees.

A foreign transaction fee is assessed by the credit card issuer and is usually charged as a percentage of each purchase, generally around 3%. A currency conversion fee, on the other hand, is assessed by the card’s payment processor and is, therefore, less obvious. To find out the full currency conversion fee, a traveler might have to compare their store receipt to the transaction cost on their statement.

Fortunately, there are ways to avoid these additional costs. Some credit cards do not charge foreign transaction fees, and some credit card issuers pay the currency conversion fee to the payment processor for the customer. Travelers should consult their credit card company about these fees before making international purchases. And, if you will be in another country for quite a while - be sure to shop around for a "foreign-friendly" credit card before you leave!

Read the full article here:

What Is a Foreign Transaction Fee? #wanderlusting

Related Content:

Thinking about a hostel? Read these tips first

Submitted by Wanderlust AndiMany people look for ways to save money when they are traveling and one of the ways they could be able to do so is staying in a hostel. Yet many people do not know what they should expect when it comes to a hostel. Indeed much different from staying in either a motel/hotel type accommodations, one should come with proper expectations in mind before they decide to stay the night.

As a pedestrian, do you have the right-of-way?

Submitted by Wanderlust AndiLabor day road trip? Save money - and enjoy!

Submitted by Wanderlust AndiLabor day is near - but you can still take a road trip!

Submitted by Wanderlust AndiSome helpful tips for you Labor Day travel

Submitted by Wanderlust Andi- 1 of 13

- next ›